Content

- Incentivize early payments with discounts

- What Would Be Considered a Good Days Sales Outstanding Ratio?

- Historical DSO Calculation and Trend Analysis

- Days Sales Outstanding (DSO): Meaning in Finance, Calculation, and Applications

- Days Sales Outstanding (DSO): Definition & Formula

- Accounts Receivable Turnover Ratio:

In theory, a company or a sector that is accustomed to selling on credit will have a higher DSO. Biltrust’s Order-to-Cash Automation Software reduces DSO and your AR team’s manual work, optimizes your cash flow and more. The Billtrust Blog offers informative accounting insights, advice on automated AR best practices, tips and tricks, and strategies to optimize your AR processes. Chaser’s outsourced credit control services are significantly more cost-effective than in-house teams while offering a flexible and proactive service. If you’re constantly chasing customers for payment, it’s not going to do wonders for your relationship with them. In fact, they may start to view you as a nuisance rather than a valuable supplier.

- DSO is a critical business metric because it determines the financial situation and growth.

- For example, it may indicate that a company’s credit terms are too tight and are impeding sales.

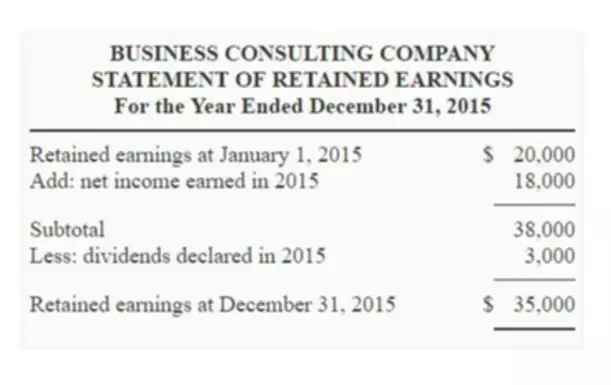

- A knowledge of how both financial ratios are trending can help managers and potential investors understand the company’s cash flow.

- These, along with inventories, make up the main element of your working capital.

- Many business analysts point to poor cash management as the number one reason that businesses go bankrupt.

If you ask any CFO out there, they will tell you that cash flow is the heart of a business. For that purpose, companies use DSO or Days Sales Outstanding to better understand their cash flow or liquidity. With this essential metric, a business can deduce financial clarity and analyze its cash flow.

Incentivize early payments with discounts

Generally, a DSO under 45 is considered low, but this really depends on your business and industry. Do a little research in your particular industry to see what is accepted as a “normal” DSO for you. Let’s say you run a B2B company that generates about $365 million in credit sales. If your average accounts receivable (AR) balance for a given month is $48 million, that means you have 48 days worth of sales sitting on your book. It’s important to start understanding your Days Sales Outstanding ratio and how it’s affected by your credit sales. At the end of the day, calculating DSO and reducing it is all about improving your cash flow.

Upon evaluating her progress she noticed that some of her receivables sat in wait. The accounts receivable (A/R) line item on the balance sheet represents the amount of cash owed to a company for products/services “earned” (i.e., delivered) under accrual accounting standards but paid for using credit. A company that sells many holiday items may have a high DSO in the fourth quarter and low DSO in dso definition the first quarter. In that case, its DSO should be evaluated by comparing this year’s first quarter to last year’s first quarter. A high DSO value illustrates a company is experiencing a hard time when converting credit sales to cash. But, depending on the type of business and the financial structure it maintains, a company with a large capitalization may not view a DSO of 60 as a serious issue.

What Would Be Considered a Good Days Sales Outstanding Ratio?

In addition, all the company needs to do is to ensure that the customers are well-informed about this policy upon the establishment of such payment systems. Besides that, the company will also need to have its clients notified every time a payment has been drawn from their bank accounts. – Devising better strategies motivating the payment collections department to maintain a strong proactiveness in keeping outstanding accounts receivables at a minimum. This is because a company’s DSO value could change regularly on a month-to-month basis, especially if its products and/or services are of a seasonal nature. Should a business present a volatile DSO performance, this would be a cause for concern. However, if its DSO declines during a specific season every year, it may simply be a natural phenomenon that the management need not worry about.

You count back every month until you find your gross sales are higher than your A/R. If you want to calculate your DSO over a year, using the simple method will not take into account any seasonality in your business. So if your business is closed in August or doesn’t do much turnover in December, your DSO calculation will not be accurate. In an increasingly data-driven business landscape, tracking the right KPIs for your accounts receivable…

Historical DSO Calculation and Trend Analysis

Because if the lungs aren’t operating at maximum efficiency, neither is the rest of the body. A healthy or concerning DSO ratio would largely depend on the nature of the business and the industry verticals in which the firm is operating. If the company happens to be running a business with a subscription-based revenue model, auto-charging its clients might be the optimal approach to managing its DSO ratio. On that note, the firm ought to consider keeping records of its client’s credit card details so that they can be automatically charged on a set date each month.

- Recall that an increase in an operating working capital asset is a reduction in FCFs (and the reverse is true for working capital liabilities).

- Let’s say you run a B2B company that generates about $365 million in credit sales.

- The Days Sales Outstanding, for a given company, is the average time of payment for its commercial invoices.

- Depending on your industry, that might be a low DSO or a higher DSO than average.

- Due to the importance of having a healthy operational cash flow when running a company, it would be in the firm’s best interest to ensure that it collects all outstanding accounts receivables as soon as possible.

- To that effect, the DSO is a key indicator of the financial health of your company.

So when considering DSO vs DPO, remember that DSO is the average number of days it takes your customers to pay you, while the DPO is the average number it takes you to pay your suppliers. Cash sales are not included in the DSO calculation and could be considered like having a DSO equalled to 0. Your DSO – for Days Sales Outstanding – is a key metric that calculates how long it takes for you to get paid.

Days sales outstanding calculation

Like any metric measuring a company’s performance, DSO should not be considered alone, but rather should be used with other metrics. B2B customers also increasingly prefer to pay online as it’s more convenient. In a recent Versapay survey, the top reason finance leaders said they were offering their customers digital payment methods (cited by 76% of them) was that https://www.bookstime.com/ they’re simply easier for customers to use. That means it takes the business on average 51 days to collect on their invoices. It’s assumed sales made on cash are collected upfront (and would have a DSO of 0 as a result). Based on the above information, the CFO asked her collections team to present her with options to lower the company’s actual DSO by seven days.

How is DSO calculated?

To calculate DSO, divide the total accounts receivable for a given period by the total credit sales for the same period, and multiply the result by the number of days in the period. Days Sales Outstanding = (Accounts Receivable/Net Credit Sales)x Number of days.

Furthermore, DSO can also be used to examine the company’s overall efficiency and profitability. Low accounts receivable collection times means a company can more efficiently reinvest their cash in order to generate more sales. An effective way for businesses to use the DSO calculation is to keep it tracked month by month on a trend line — or a series of plotted data points indicating a certain pattern or direction. Using the DSO in this way can help companies see any changes in their business’s ability to collect payments from customers. A seasonal business can use a variation of this analysis by tracking the same month’s metric on a year-by-year rate. Offering incentives such as discounts or coupons to early-paying customers will improve your DSO.

Providing Incentives for Clients Who Are Punctual or Early with Their Payments

Changes in DSO (up or down) reflex changes in key inputs from a company’s balance sheet. Many companies will try to establish a benchmark for DSO in their industry and compare themselves with that. Companies will also monitor their days sales outstanding (DSO) and take note of any changes as indicators of the changing efficiency of their AR processes.

A high DSO number can indicate that the cash flow of the business is not ideal. If the number is climbing, there may be something wrong in the collections department, or the company may be selling to customers with less than optimal credit. Divide the total number of accounts receivable during a given period by the total dollar value of credit sales during the same period, then multiply the result by the number of days in the period being measured. If you want to calculate your DSO for the quarter, take your total receivables for those 3 months, divide them by your total net credit sales during that period and multiply the quotient by the number of days in the period. For instance, if you were calculating your DSO for January to March, you would multiply the quotient by 90 days. That’s why it’s important for businesses that make most of their sales on credit (which a great majority of B2B companies do) to have a solid understanding of their available cash and overall financial health.

Days Sales Outstanding (DSO): Meaning in Finance, Calculation, and Applications

The exception is for very seasonal companies, where sales are concentrated in a specific quarter, or cyclical companies where annual sales are inconsistent and fluctuate based on the prevailing economic conditions. On the other hand, DSO decreasing means the company is becoming more efficient at cash collection and thus has more free cash flows (FCFs). NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. To that effect, the DSO is a key indicator of the financial health of your company. Of course, you can also use DSO calculation formulas to monitor your financial health over the years… For instance to see how a change in your pricing or profitability margin affects it.

DSO can be calculated by dividing the total accounts receivable during a certain time frame by the total net credit sales. This number is then multiplied by the number of days in the period of time. All in all, measuring the mean time taken for a corporation’s outstanding accounts receivables to be settled may present important information regarding the health and nature of its operating cash flow. Meanwhile, it is also crucial to take note that the DSO ratio formula only takes credit sales into account whilst excluding cash sales.